Here’s a fact that keeps display execs up at night: Your entire transparent electrode supply chain hinges on a metal you don’t actually buy. Indium is a byproduct of zinc mining—its supply is tied to construction demand, not your panel forecasts. When a factory manager told me his “indium price risk” budget now exceeds his maintenance capex, I knew the game had changed. Aluminum-doped Zinc Oxide (AZO) has been the heir apparent for years. But in recent years, “apparent” is turning into “urgent.” Let’s talk about what’s real, what’s fixed, and who’s already making the switch.

The Unfixable Problem with ITO

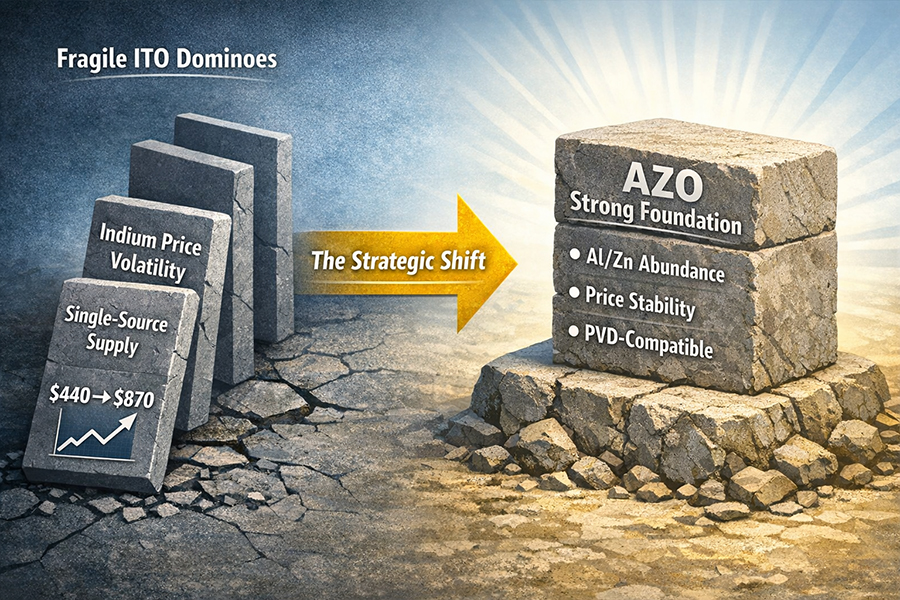

Forget performance for a second. Indium Tin Oxide (ITO)’s fatal flaw is economic. It’s built on a market that makes no sense for displays.

-

You Can’t Buy What Isn’t For Sale: Indium supply doesn’t increase when display demand spikes. It increases when China or Canada decides to produce more zinc. Your raw material availability is decided by the global construction industry. That’s not a supply chain; that’s supply chain roulette.

-

The CFO’s Nightmare: Look at the numbers. At the start of 2023, indium was around $440 per kg. By early 2026, some market projections place it near $870 per kg—nearly doubling in just three years. This isn’t normal commodity fluctuation; it’s a systemic supply shock. Trying to build a stable product cost model on that curve is impossible. For a high-volume fab, this volatility doesn’t just hurt margins; it incinerates them. We’re talking about eight-figure swings in annual raw material costs dictated by a market utterly disconnected from display demand.

-

The Single Point of Failure: Over half the world’s refined indium comes through one country. In today’s geopolitical climate, sourcing from a single region isn’t just risky; it’s reckless. Board-level supply chain reviews are now mandating alternatives, not just exploring them.

Oh, and by the way, ITO is brittle. It cracks when you bend it. For the rollable TVs and foldable phones every brand is betting on, that’s a physical deal-breaker. The move away from ITO isn’t driven by engineers wanting something better; it’s driven by finance and strategy teams demanding something less insane.

AZO’s Three Big Hurdles – And Where They Stand Today

AZO’s pitch is simple: swap expensive, volatile indium for cheap, stable aluminum and zinc. The catch? For years, AZO failed three basic factory tests: it hated humidity, was a pain to etch, and couldn’t perform consistently on big glass. Here’s the report card.

1. Humidity Stability: From “Fails” to “Qualified”

Old AZO films would soak up moisture like a sponge, and their electrical resistance would tank. The issue was grain boundaries—the tiny cracks between crystals where water molecules would get stuck.

-

The Fix: Smarter Doping. We stopped just adding aluminum. Now, we add a tiny bit of magnesium or titanium during the sputtering process. These “co-dopants” don’t just carry current; they force the zinc oxide crystals to grow denser and more uniform. Fewer gaps for water to creep into.

-

The Seal: As a final step, we add a 20-nanometer aluminum oxide barrier using the same ALD tools already in fabs. It’s an invisible, glass-like seal. The result? AZO films now routinely pass the 1,000-hour, 85°C/85% relative humidity stress test—the industry’s gold standard for reliability.

2. Etching: From “Messy” to “Controlled”

ITO etches cleanly. Early AZO did not; it left gunk on the panel or etched unevenly, killing yields.

-

What Changed: We Stopped Fighting Chemistry. The key was realizing that the sputtering conditions dictate how the film etches. By tightly controlling oxygen levels and substrate temperature during deposition, we can “tune” the AZO film’s crystal structure. The right structure etches in dilute hydrochloric acid with a clean, vertical profile—just like ITO. The etch process is now a known, stable variable.

3. Large-Area Uniformity: The Make-or-Break

Any lab can make a great 4-inch AZO sample. The challenge is getting the same performance on a TV-sized sheet of glass (Gen 10.5 is over 3 meters wide).

-

The Core Issue: Dopant Distribution. In a large sputtering target, the aluminum must be perfectly evenly mixed with the zinc oxide. Any variation gets printed onto the glass as blotchy resistance.

-

The Solution: Rotary Targets & Advanced Bonding. The leading suppliers now use large rotary cylindrical targets. As the target spins, it wears evenly, ensuring consistent aluminum delivery. Coupled with proprietary diffusion bonding that can handle intense heat, they guarantee sheet resistance uniformity of better than 5% across massive panels. This isn’t materials science anymore; it’s precision manufacturing.

The Competitor Landscape: It’s Not Just ITO vs. AZO

AZO’s real competition isn’t ITO. It’s the other “next big things.”

-

Silver Nanowires: Great for flexibility, a manufacturing headache. It’s a wet coating process, completely different from standard PVD lines. It also suffers from haze and long-term corrosion worries. It’s a niche player.

-

GZO (Gallium-Doped Zinc Oxide): Slightly better performance than AZO, but gallium is expensive and has its own supply questions. You’re trading one problem for another.

-

Conductive IGZO: Still uses indium. It’s a reduction, not a replacement. A half-step.

| Technology | The Pitch | The Catch (Factory Reality) | Best For… |

|---|---|---|---|

| Silver Nanowires (AgNW) | High flexibility, great conductivity. | A different process entirely (wet coating). Issues with haze, adhesion, and long-term corrosion. A reliability gamble. | Flexible prototypes and consumer devices with shorter lifespans. |

| GZO (Ga-doped ZnO) | Slightly better conductivity than AZO. | Gallium is expensive and has its own supply chain questions. You’re swapping one strategic material risk for another. | Performance-first niches where cost is no object. |

| Conductive IGZO | Excellent performance, familiar process. | Still contains indium. It’s a reduction, not elimination. A transitional solution. | Ultra-high-resolution displays where every bit of performance counts. |

| AZO | Drop-in PVD replacement. Cheap, stable materials. | Historical weaknesses (humidity, etch, uniformity) are now solved at scale. | Volume production of rigid displays, cost-driven applications, and de-risking the supply chain. |

AZO’s Value Proposition: It’s the drop-in replacement. It uses your existing PVD tools. Its raw materials are cheap and abundant. Its historical weaknesses are now solved. It’s the pragmatic, low-drama choice for volume manufacturing.

Who’s Switching Now? (A Real-World Case)

A major supplier of automotive center console displays was getting hammered by quarterly indium price swings. They couldn’t pass the costs on to their automaker clients, so margins were evaporating.

-

The Pilot: They replaced the ITO target in one of their touch sensor sputtering tools with a production-grade AZO rotary target. The tool needed a new recipe, but no new hardware.

-

The Timeline & Results:

-

First 30 days: Yield dip of 7% during process optimization.

-

By Day 90: Yield back to baseline. Optical and electrical specs matched ITO exactly.

-

The Bottom Line: A 25% reduction in bill-of-materials cost for the electrode layer. Even better, they locked in a multi-year fixed-price contract with their AZO supplier. They eliminated a massive financial unknown.

-

This wasn’t about building a better display. It was about building a predictable, profitable business. That’s the real driver.

So, Should You Be Looking at AZO?

Ask yourself these questions:

-

Is your product rigid or flexible? For rigid displays (monitors, TVs, most touch panels), AZO is ready. For highly flexible displays, the race is still on.

-

Is cost and supply security a board-level issue? If your finance team is sweating indium prices, AZO is no longer an R&D project—it’s a strategic procurement initiative.

-

Are you building new capacity? If you’re outfitting a new line, qualifying AZO from the start is a no-brainer for future-proofing.

The conversation has shifted from “Can AZO work?” to “Which AZO supplier has the proven production track record for my glass size?”

Stop reading reports. Start testing production-ready samples.

Contact Us Now! Send us your substrate specs and current ITO consumption. We’ll provide target samples that match your tooling and a detailed breakdown of potential cost savings and qualification steps.

-

Sputtering Targets Materials. (2023, August 10). Exploring aluminum doped zinc oxide: Properties, applications and technological advances.

https://www.sputtertargets.net/blog/exploring-aluminum-doped-zinc-oxide-properties-applications-and-technological-advances.html -

Strategic Metals Invest. (n.d.). Indium prices. Retrieved January 27, 2026.

https://strategicmetalsinvest.com/indium-prices/ -

Alter Technology. (n.d.). Highly accelerated stress testing (HAST).

https://semiconductor.altertechnology.com/laboratory-services/environmental-testing/highly-accelerated-stress-testing-hast/ -

National Center for Biotechnology Information. (2023). Recent advances in the stability of aluminum-doped zinc oxide thin films for transparent electrode applications [PubMed Central record].

https://pmc.ncbi.nlm.nih.gov/articles/PMC10456026/ -

Sputtering Targets Materials. (2022, November 15). Main methods of PVD coating.

https://www.sputtertargets.net/blog/main-methods-of-pvd-coating.html